3 Best Practices for Your Financial Services Marketing Strategy

Financial services marketing describes the techniques that marketers must use to capture and retain customer interest within the financial services industry. Financial services marketers are tasked with generating consumer interest through clever attention-grabbing tactics mixed with solid financial education.

Today, this basic formula still works – but the changing marketing environment for financial services demands additional scrutiny from marketing teams. Between rising consumer expectations, disruptive events like the COVID-19 pandemic, and mounting concerns about data privacy, marketers are working in an environment that would have been difficult to imagine just a few years ago.

It’s difficult to stay well-read on these trends while keeping your technology and processes up to date with the disruption. Unfortunately, there’s slim room for error: The industry is incredibly competitive. If you can’t stand toe-to-toe with the biggest names in the industry, you’ll be fighting with the bottom of the pack over low-value, risky customers.

You need to take a flexible and analytical perspective to financial services marketing to get ahead. Here are three areas you should pay close attention to in your marketing outreach, and details on how you can get there.

Become Customer-Obsessed to Enhance Their Experience

A focus on products and services is going the way of the dodo. Many customers simply don’t understand the complexity behind many financial concepts, so talking about your interest rates or FDIC rating in an objective manner could easily go over their heads. Instead, you need to take a customer-obsessed view and communicate the benefits that those customers want in a way that resonates.

Start by thinking about who you’d like to win over generally, and then think if there are any subsegments. Every bank wants high-value customers – but which customers provide the most value for your institution currently? Segmenting high-value customers will give you a strong basis for your target audience.

Once you can generally identify these segments, it’s important to look closely at highly granular aggregate datasets to understand these customers in a qualitative and quantitative way and create microsegments. Let’s say you start off by targeting customers who are contributing the top 20 percent of your revenue. Are there any key subsegments within this group? If so, what are their demographics? How did they interact with your bank before choosing you? Which marketing materials do they still respond to?

After you’ve broken these segments into well-defined microsegments, you’re ready to start focusing on bolstering their experience, and acquiring customers just like them. This should be reinforced by not only marketing outreach, but an ongoing brand building initiative.

Build a Brand Image of Trust and Success

A good brand provides the baseline perception of your business in the eyes of the consumer. It is a fundamental counterpart to a strong marketing strategy. Think of it this way: It’s important for your credit union’s marketing outreach to communicate the importance of your impressive APY, but if customers don’t think credit unions are as secure as a Big Five bank, they’ll never want to trust you with a majority of their finances.

You could have the best fraud and data protection in the business, but a shocking number of consumers tend to operate on gut feelings. Building a strong brand will overwrite any preconceived notions that consumers may have and leave them more receptive to future marketing messages. For this reason, improving your brand equity and tracking your brand performance is paramount.

Make sure you have a marketing performance solution that’s equipped to track and optimize your brand using unified marketing measurement. This model will help you identify which metrics best predict sales by linking attitudinal survey responses to purchasing activity for your chosen microsegment. This isn’t inherent in every marketing analytics solution, so be discerning.

Once you’re using your performance measurement solution, analyze your brand campaigns to determine which factors actively drove brand engagement for your target segment, broken down by demographic and psychographic information. This will help you understand which groups are receptive to your messages, and which groups need further outreach. As a result, you’ll know precisely which media buys are working, helping you guide the development of more acquisition-focused outreach.

Assess the success of creative and content marketing

Creative assets are central to any marketing campaign, but it’s not always easy to determine how well your content and creative is resonating with your target audience. This can be problematic for the financial services industry. Without authentic storytelling and great financial education, it’s difficult for the average consumer to understand how you stand out from the competition.

For this reason, it’s important to analyze both user-level and aggregate data to uncover purchase drivers, behaviors, and attitudes for certain microsegments within your audience. For example, you may find that males under 30 were responsive to your Reddit ad that provided a guide for financial growth. On the other hand, females over 30 were responsive to Instagram ads that clearly outlined the benefits your institution can offer to potential homebuyers.

With this information, you could justify an increased investment in targeting men under 30 with general financial advice and divert a share of your spending for women over 30 into home-buying guides. If you’d like to take it a step further, you could A/B test multiple versions of the same ad to ensure you’re choosing the most impactful image and copy for your ads. This will help you optimize your marketing spend.

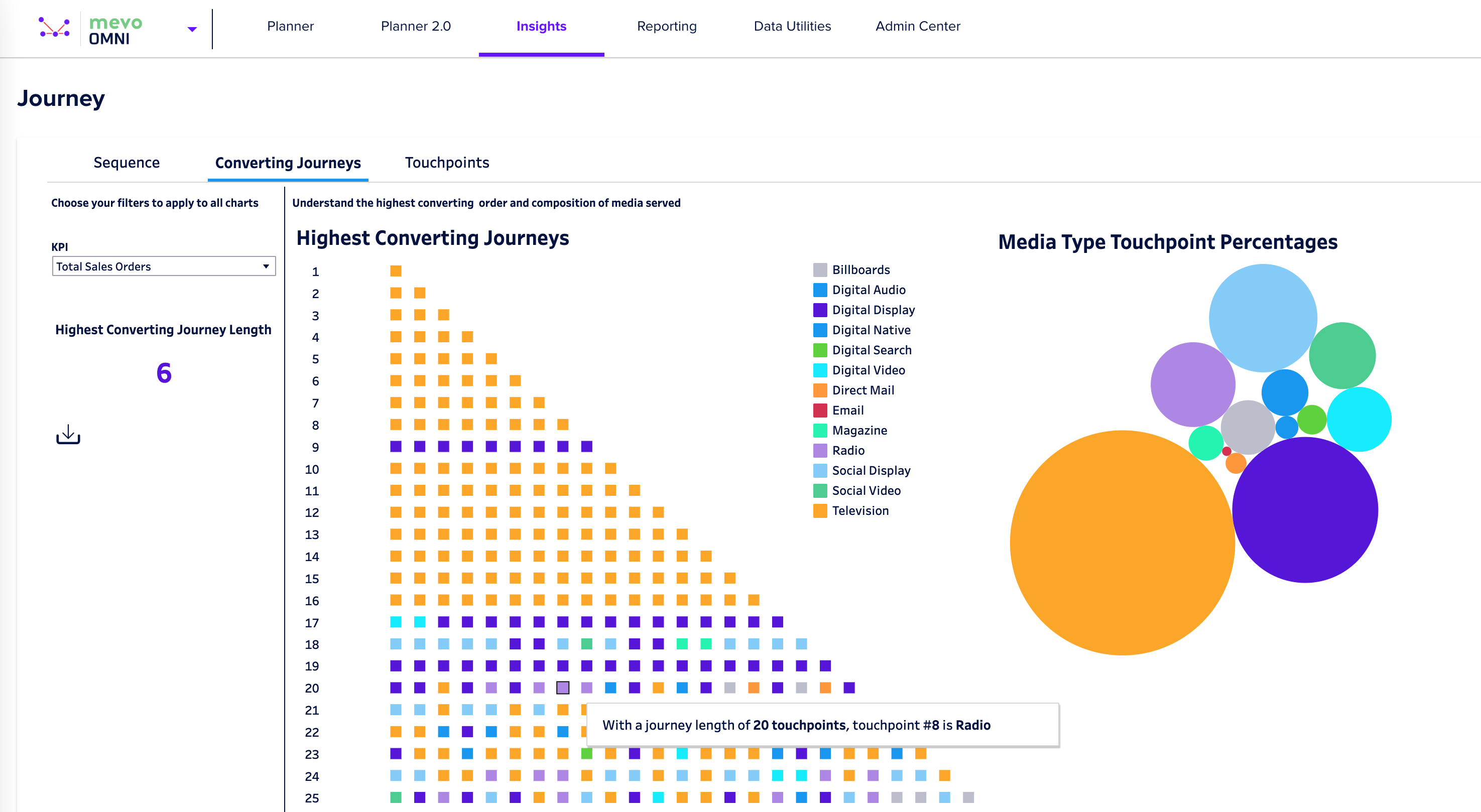

It’s crucial to invest in a flexible marketing analytics solution that can perform a multichannel analysis on each marketing placement you invest in, whether it’s a nationwide mass marketing campaign or just the messaging you display on your ATM’s idle screen. It should be able to precisely outline how each touchpoint influenced conversions or engagement, and allow granular cross-examination based on your audience segment, the vehicle of delivery, the subsequent cost-per-acquisition, and more.

In the end, you’ll receive a clear picture of which assets pique the interest of your chosen group.

Final Thoughts

The financial services industry relies on customer interest and ongoing education for continued success. Subsequently, paying close attention to the cause-and-effect behind your marketing and branding activities is crucial. You need a solution that will help you sift through the mountains of data available to your team from disparate locations and consolidate it in a way that is intuitive and easy to understand.

In today’s ever-changing marketing environment, the business with the best understanding of their customer’s needs – and therefore, the most control over customer data – will win. Make sure you’re positioned to come out on top.