Is Retail TV Advertising Making a Comeback?

Recent statistics have shown that retailers have rediscovered an affinity for TV advertising. During July and August of 2019, department stores in the United States spent 9.3 percent more on TV advertising than they did during the same time period in 2018. This caused television ad spending to grow from $226.7 million to $247.8 million. This is primarily due to two factors: Marketers have access to better online and offline media optimization technology, while networks are innovating new ways to reach consumers over their TV set.

With 46 percent of retail store visitors originating from a cross-channel marketing initiative, marketers must fully understand where, when, and how customers interact with their brand – and consequently understand how TV influences conversions. Let’s take a look at the primary reasons why TV advertising is making a comeback.

Connected TVs Allow Granular Audience-Based Marketing

Consumers have changed the way that they watch TV over the past two decades. In the late 2000s, streaming services like Netflix and Hulu emerged, and immediately generated a buzz among both consumers and marketers. As the 2010s wore on, Smart TVs that collect and utilize user information integrated with these streaming services, and became more and more commonplace in the average household. In fact, 2019 was the first year that a majority of television sets were connected to the internet.

This new, connected nature of TV has created novel opportunities for marketers – especially as programmatic ad buying continues to advance. Through programmatic purchases, marketers can use data from connected televisions to make the ideal ad purchases for the best possible price. While this data offers great opportunities for marketers, it can become a burden without the right analytical processes.

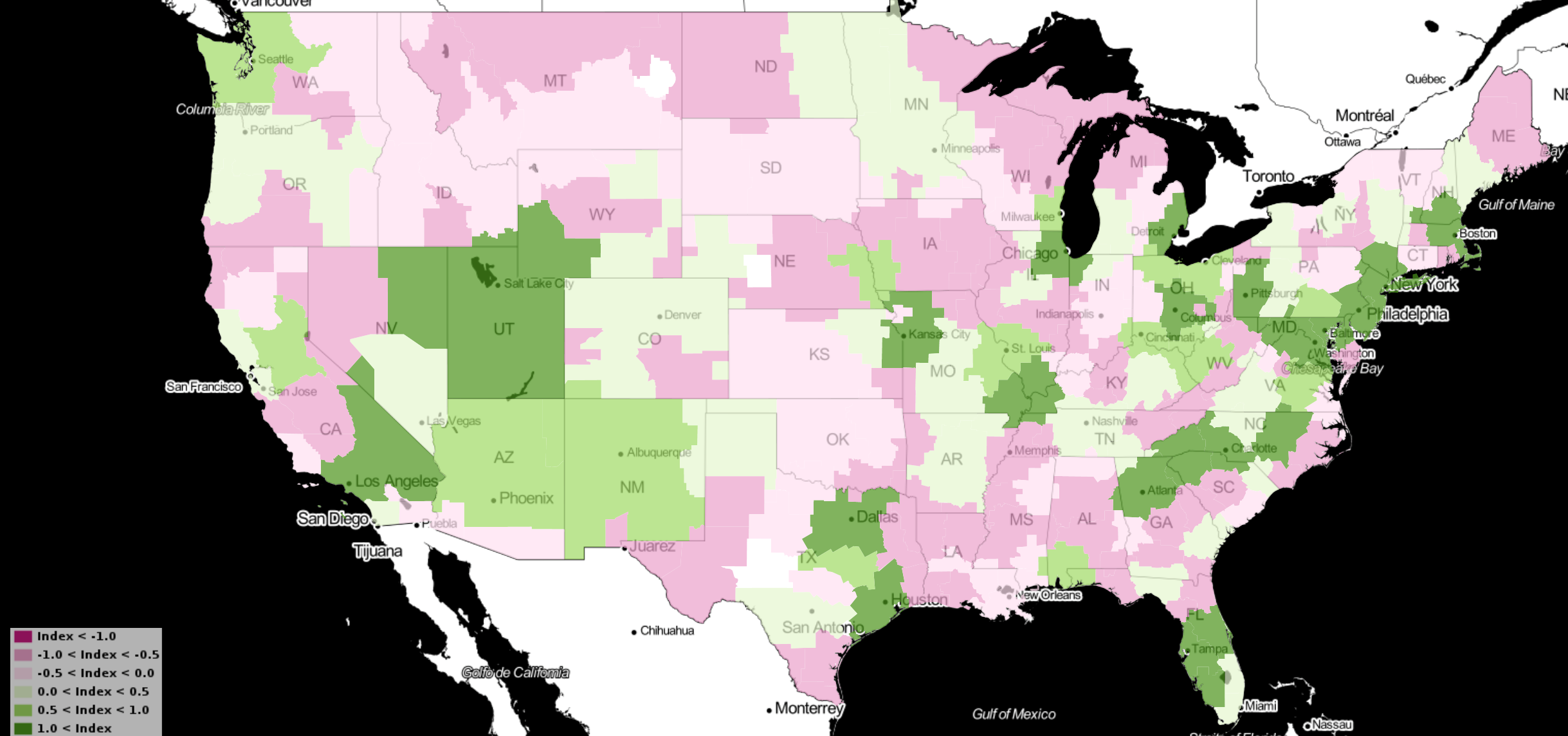

To make the most out of connected TV, marketers need strategic planning guidance that will provide data-driven recommendations on ad purchasing. This includes accurate information on the most impactful networks, the programs that perform the best, and the optimal budget allocation for these ad placements. This will allow marketers to understand where they need to be more aggressive, where they need to cut back, and how to approach their market differently.

New Innovations in Audience-Based Marketing

Imagine that you’re watching a professional golfer tee up on live TV, when you notice them take out an unconventional and well-crafted golf club. When they seamlessly make an albatross, you may wonder which brand of club they were using. Naturally, advertisers want to seize customers at this exact moment of wonder. To meet this demand, many networks are introducing new ways for consumers to shop using their TV.

Take NBCU’s “ShoppableTV” for example. This allows advertisers to purchase ad space with a QR code whenever their product or service is shown on screen. At this point, consumers can use their phones to scan the QR code, and be taken directly to the product page for simple purchasing.

NBCU tested this technology during a Mother’s Day episode of “Jill’s Steals and Deals” on The Today Show. For a little less than 5 minutes, Jill showed off gift ideas for Mother’s Day while a QR code appeared in the left-hand corner of the screen. For the duration of the segment, 50,000 viewers scanned codes for products like dishware and luxury candles. After the segment, NBCU attributed hundreds of thousands of dollars in sales to ShoppableTV alone.

These innovations – dubbed “watch & shop” by some – aim to make purchasing over your television as simple as purchasing online. This creates a direct connection between TV ad placements and sales, making it simpler for marketers to measure conversions in a meaningful way. Marketers can anticipate that networks will continue to innovate in order to ensure that TV remains a viable marketing channel for years to come.

Advanced Measurement & Media Optimization Software

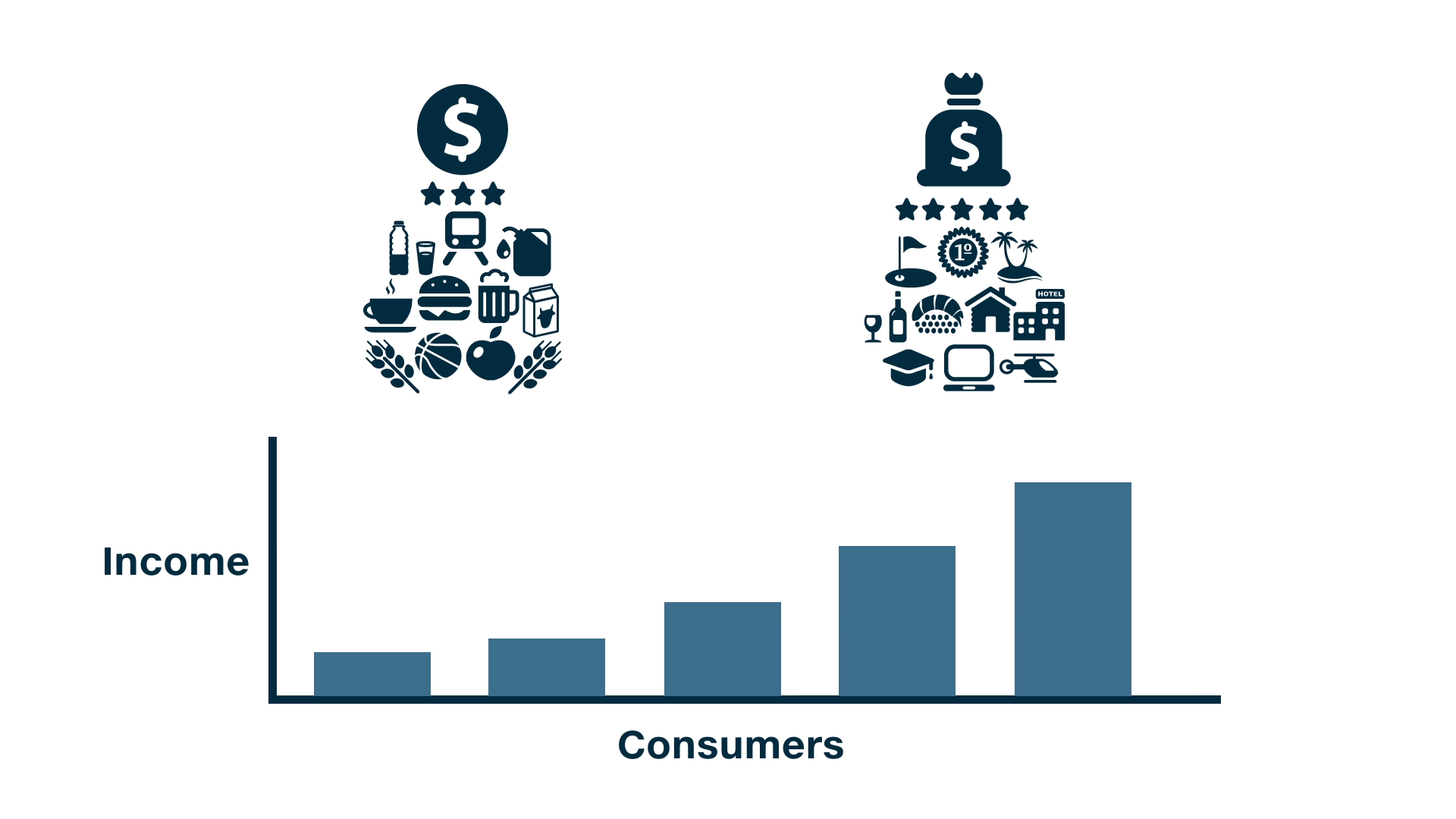

In today’s data-dominated marketing environment, accountability is everything. With the rise of digital media and omnichannel campaigns, CMOs and CFOs are demanding that marketers provide an accurate breakdown of which channels and campaigns provided the best marketing ROI.

Unfortunately, at the beginning of the digital revolution, many marketers struggled to understand how to properly attribute their marketing data. On one hand, digital provided detailed customer data, which was simple enough to record and analyze. On the other hand, network television could only provide rough estimates of how many ad exposures took place. This lack of clarity led marketers to over or underestimate the impact of offline channels like television.

Since the average individual in the United States reports watching TV for five or more hours every day, this cumulated into a gigantic missed opportunity for many retailers. Without the right data, they were unsure of how to maximize the impact of their ad exposures. Thankfully, when marketers called for help, media optimization vendors were listening.

Today, advanced marketing technology allows marketers to gain an accurate estimate of how much a TV exposure contributed to sales – whether those TVs are connected or unconnected. With the right media optimization software, marketers can leverage data that makes them more confident in their TV purchasing decisions. With this increased confidence from marketers, TV advertising has had an opportunity to grow.

Final Thoughts

While television advertising hasn’t had a rosy outlook for the past decade, networks and television manufacturers are working diligently to turn that around. At the same time, marketers are investing in technology that will allow them to understand the true impact that television advertising has on both sales and brand value.

At the center of all of this is data – when networks provide the right data, marketers are better able to piece together how television advertisements impact the entire customer journey and encourage conversions. If marketers can take advantage of TV networks reinventing the way they reach consumers, both marketers and networks stand to gain a competitive advantage.