The Run Stage: Unlocking Marketing ROI with the ROI Brain®

Deep Dive: Run

Having moved successfully though the Crawl and Walk stages, building familiarity with the optimization and confidence in your team’s ability to lead the process, your team is ready to run. In the Run phase, we’ll be relying more on our marketing analytics software, the ROI Brain®, to implement the majority of our marketing optimizations with the team focused on Test and Learn and next order performance initiatives.

The Run stage is characterized by:

- Adding Test & Learns

- Building leading indicator model

- Performing meta-analysis for best practices

- Migrating to portfolio optimization when appropriate

- Validating the upside and impact on shareholder value.

The goal of the Run stage is to increase speed, accelerate learning, and use the ROI Brain® as the source of truth.

Adding Test & Learns

As Scott Frederick, CMO for CARFAX put it, “Once we have the ROI Brain® stood up in our team, our job becomes feeding the brain with new inputs.”

There is a button in the software called “Learning agenda.” This starts as a parking lot for things the marketing organization and agency would like to learn. In agile marketing, this is the backlog of value and growth hypotheses. When organizations move into the Run stage, they shift their orientation from planning based on past performance to a 70/20/10 rule of innovation. 70% of the budget goes to the proven plan, 20% goes to Test & Learns that are adjustments to the core plan, and 10% goes to out of the box ideas that have a shot at transforming marketing effectiveness. You can adjust the ratios but having some budget in each of these categories is important.

Building a Leading Indicator Model

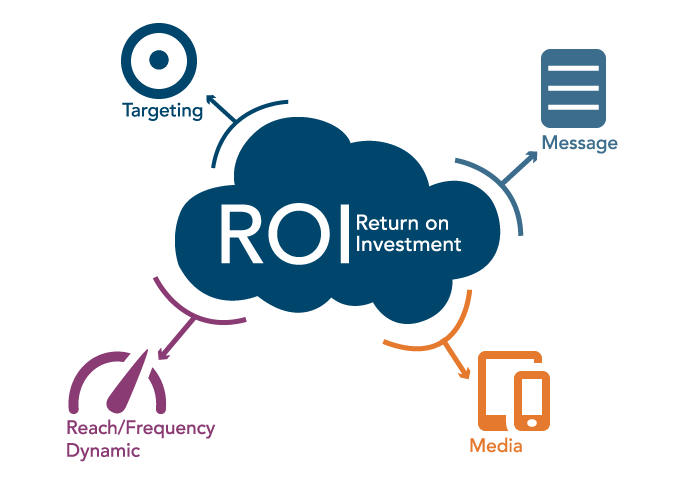

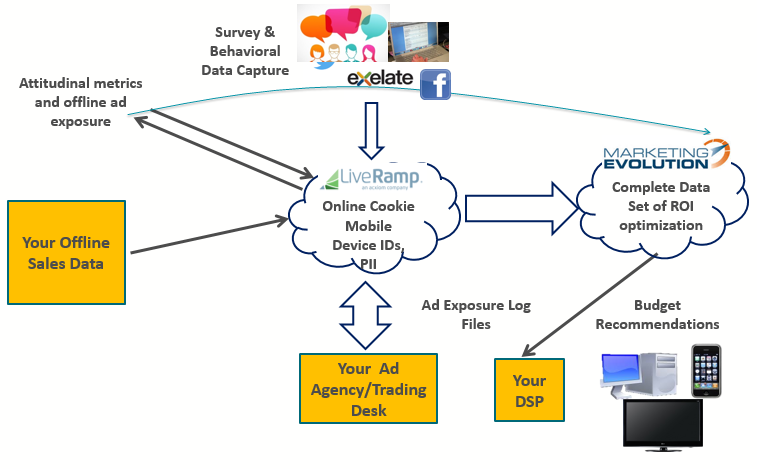

The vast majority of marketers that spend on advertising are trying to influence future sales by building a brand. When we analyze person level data longitudinally, over time, we can identify and strengthen the brand perceptions that drive sales and profits. We may also find that there is a path to purchase that produces data, such as website visits, Google searches for your products, or conversations about your product on Facebook. There may be other factors like the distance someone lives from your store (if you are a retailer), or the weather conditions. Marketing Evolution or your own data science team can use all the data feeding into the ROI Brain® to create a leading indicator model. Rather than looking back at sales attribution, a company in Run mode looks forward, and optimizes for the next sale.

Performing Meta-Analysis for Best Practices

By the end of the first year, Marketing Evolution has accumulated enough data to begin meta-analysis.  Typical meta-analysis of messages leads to best practice guidelines. A ranking of the strongest to weakest performing advertisements generates useful insights. But even more powerful is the meta-analysis by persona/segment. Examining certain ads that work with a particular segment, but not other segments, can give the clues for how to be relevant to specific people. The speed at which we can begin to create these powerful learning again circles back to the beginning -- brainpower put toward thoughtful creation of KPIs and target definitions pay back in the speed at which we have data structured for meta-analysis.

Typical meta-analysis of messages leads to best practice guidelines. A ranking of the strongest to weakest performing advertisements generates useful insights. But even more powerful is the meta-analysis by persona/segment. Examining certain ads that work with a particular segment, but not other segments, can give the clues for how to be relevant to specific people. The speed at which we can begin to create these powerful learning again circles back to the beginning -- brainpower put toward thoughtful creation of KPIs and target definitions pay back in the speed at which we have data structured for meta-analysis.

Migrating to Portfolio Optimization

For marketers with a portfolio of products, they can activate Portfolio Optimization. Portfolio examines which product/offer is best for each consumer at any given point in time. It solves for the most productive use of financial resources to achieve the greatest impact for the marketers, and greatest satisfaction for the consumer. Portfolio optimization can be applied across multiple geographies, and across multiple marketing objectives (brand and behavior).

With Portfolio Optimization, your organization is unequivocally putting the consumer at the center of your marketing universe. The algorithm is sorting through all the product you could offer the consumer and optimizing for the next best action. It is looking across all your spending, and zero-based spending to meet your customers in the most optimal way. With a deeper understanding of your customers’ needs and intents you can more consistently deliver the right message at the right time in the right place.

Sounds like Nirvana? Maybe. Portfolio Optimization is at the frontier of what Marketing Evolution is doing today. We have the mathematical approach, but it is currently a labor intensive and expensive professional service. Importantly for our customers who have the desire to be running, a Portfolio Optimization software solution is on the horizon.

So, we are getting ready: our customers need to get ready for this also. There are significant corporate silos to blow up and governance issues to be worked out. What if the optimal zero-based answer is you stop supporting ad spend for a certain product line? Would that decision be acceptable? Like for a single brand, portfolio optimization can set minimum spend and other rules to constrain the optimization. Best practice is to run the unconstrained and constrained at different budget levels to learn why the algorithm distributes budget the way it does. This provides the critical risk/reward tradeoff needed for smart business decision-making. We suggest looking at both the overall level of spend allocation as well as looking at the person level, by examining by customer segment or persona. If it raises eyebrows, develop Test & Learns. You may unlock some powerful insights about how to optimally allocate marketing resources company wide.

Validating the Upside and Impact on Shareholder Value

Since 2004, Marketing Evolution has been working with customers to understand the impact advertising and marketing optimization can have on shareholder value. For many marketers, the consideration of corporate finance, company valuation, and shareholder value, are probably peripheral at best. Marketers may be driven more by marketing performance metrics, like web traffic, click-through rates, or CPMs, or by sales and revenue goals. These all, however, are just proxies for what ultimately matters: Building the long-term value of the company.

With experience gained over many years and with the input of multiple customers, Marketing Evolution has developed three ways to link changes in marketing effectiveness to shareholder value:

- Price to Earnings (PE) Ratio or Price to Revenue Ratio

- Model of Multiple Financial Metrics

- Third-party Brand Valuation Model

Typically, Marketing Evolution prefers precision even if it comes with more complexity. However, in this case, we have found that most often the simpler approach with directional accuracy best serves the needs of our customers. Generally speaking, in our experience, it’s easier for the CEO, CFO or Board member to more quickly understand and respond to a simple directional linkage using a well-accepted investor ratio, such as Price to Earnings (PE).

With the right model and accurate next-step decision-making delivered from a platform like Marketing Evolution’s, marketing professionals can readily appreciate the impact decisions they make will have on shareholder value. If you’re interested in a more thorough exploration of the different approaches, and the pros and cons of each, you can read Marketing Evolution’s recent article, Demonstrating Potential Impact of Optimization on Shareholder Value.